Figure out paycheck

Ad Search For Calculate Payroll that are Great for You. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty.

Gross Pay And Net Pay What S The Difference Paycheckcity

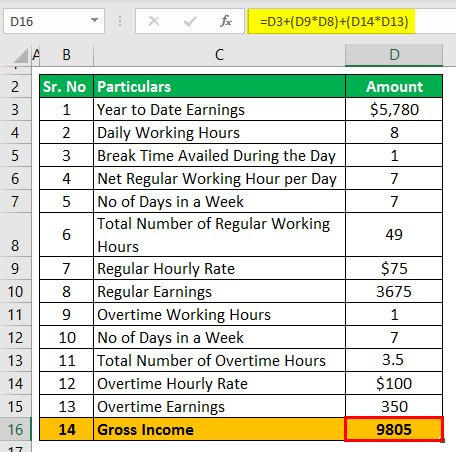

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

. Get 3 Months Free Payroll. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees.

Also known as a Federal Tax ID number your unique EIN. Estimate your federal income tax withholding. Simplify Your Day-to-Day With The Best Payroll Services.

Step 2 Adjusted. Need help calculating paychecks. Ad Learn How To Make Payroll Checks With ADP Payroll.

In order to calculate your gross pay divide your total salary by the number of periods you work in a year. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. We use the most recent and accurate information.

Ad Run Easy Effortless Payroll in Minutes. Subtract any deductions and. This number is the gross pay per pay period.

Fast Easy Affordable Small Business Payroll By ADP. Ad Choose From the Best Paycheck Companies Tailored To Your Needs. In a few easy steps you can create your own paystubs and have them sent to your email.

Search For Calculate Payroll at Discoverthebestco. Stop paying fees each time you process. Or if youre paid by the hour you can divide your hourly rate by 40.

Calculate your paycheck in 5 steps Step 1 Filing status. Simply enter their federal. Subtract any deductions and.

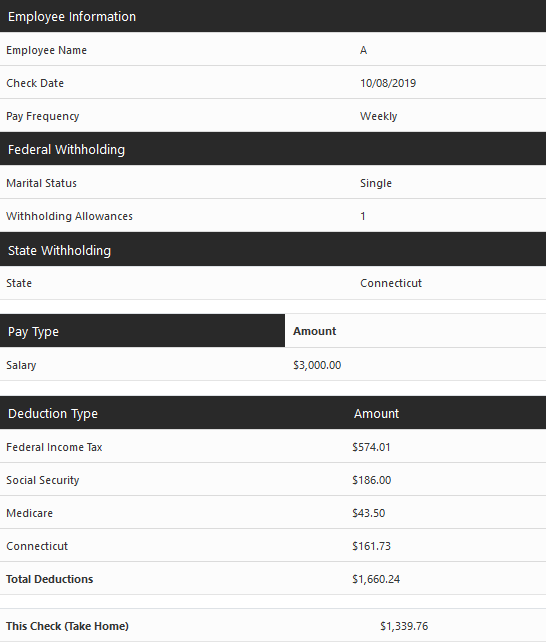

How much you pay in federal income taxes varies from person to person. For example if an employee makes 25 per hour and. Figures entered into Your Annual Income Salary should be the before-tax amount and the result shown in Final Paycheck is the after-tax amount including deductions.

Multiply the hourly wage by the number of hours worked per week. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Approve Hours Run Payroll in App.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Get 3 Months Free Payroll.

Use this tool to. How Your Paycheck Works. Ad Learn How To Make Payroll Checks With ADP Payroll.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. This number is the gross pay per pay period. Ad Create professional looking paystubs.

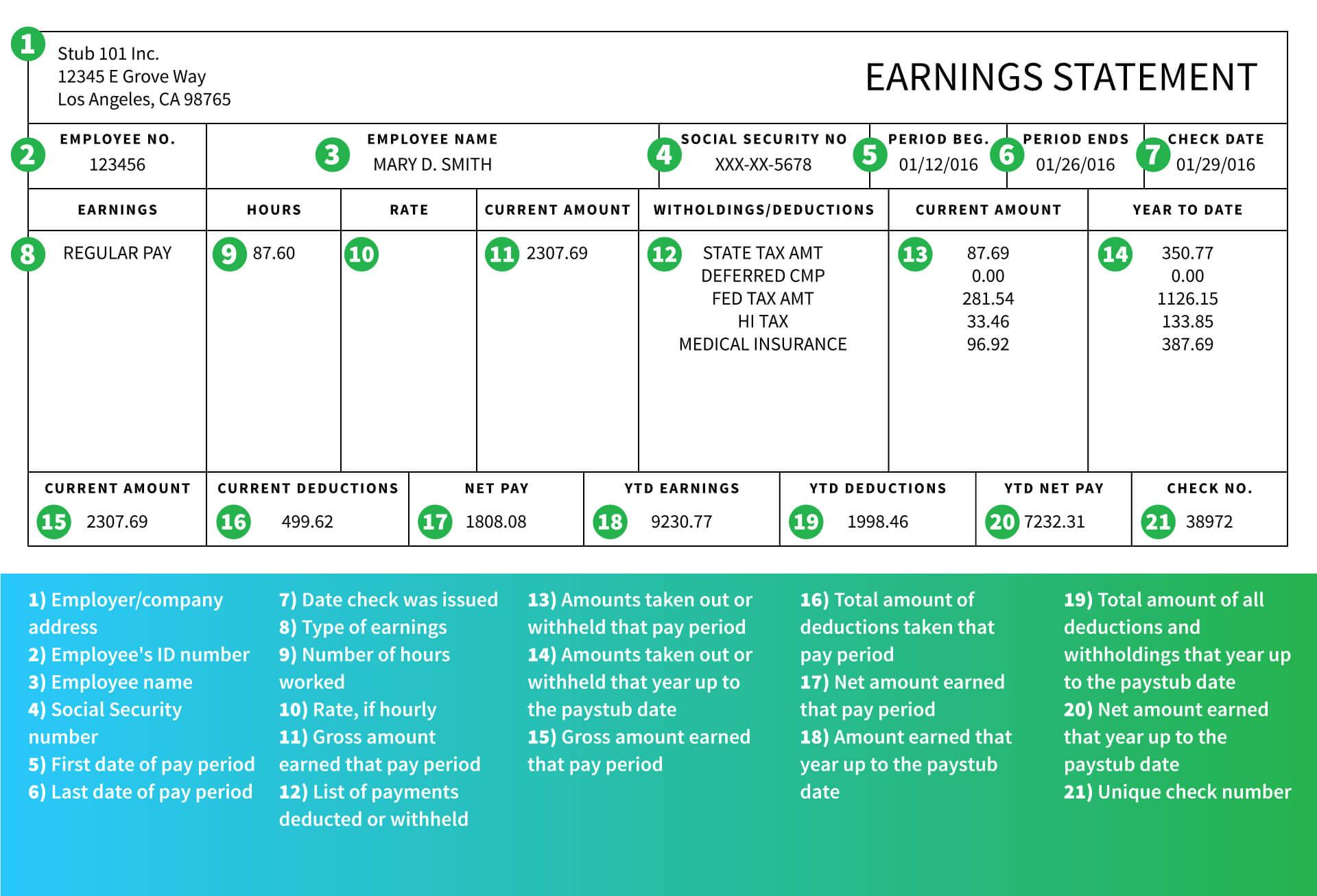

In the first quarter of 2020 the average salary of a full-time employee in the US. Ad Easy To Run Payroll Get Set Up Running in Minutes. Your marital status and whether you have any dependent will determine your filing status.

Any changes that a part-year employee makes to their withholding can affect each paycheck in a larger way than employees who work year-round. Is 49764 per year which comes out to 957 per week. Get an Employer Identification Number.

If you plan to hire employees you need an EIN for your business. While this is an average keep in mind that it will vary. But calculating your weekly take-home.

The Tax Withholding Estimator. Heres where to begin. How It Works.

Employees pay 145 from their paychecks and employers are responsible for the remaining 145. Payroll Done For You. The Best Online Payroll Tool.

See how your refund take-home pay or tax due are affected by withholding amount. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Get 3 Months Free Payroll. Fast Easy Affordable Small Business Payroll By ADP. Get 3 Months Free Payroll.

Taxes Paid Filed - 100 Guarantee. Then multiply that number by the total number of weeks in a year 52.

Free Paycheck Calculator Hourly Salary Usa Dremployee

Gross Pay And Net Pay What S The Difference Paycheckcity

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Calculator Take Home Pay Calculator

Paycheck Taxes Federal State Local Withholding H R Block

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Hourly Paycheck Calculator Step By Step With Examples

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Understanding Your Paycheck

Paycheck Calculator Online For Per Pay Period Create W 4

Net Pay Definition And How To Calculate Business Terms

Paycheck Calculator Take Home Pay Calculator

Adp Salary Paycheck Calculator Shop 55 Off Www Ingeniovirtual Com

How To Create A Paycheck For A Salaried Employee Paid 9 Months A Year

How To Calculate Monthly Income From Biweekly Paycheck Hassle Free Savings

How To Read A Pay Stub Gobankingrates